We recently talked with Jillian Dimoff, Strategic Account Executive and Loyalty expert at Marigold, about how to increase incremental spend through a brand’s loyalty programs. Her interview is below, with some very interesting takeaways.

Defining Incremental Revenue

Q: How do you define incremental revenue in the context of a loyalty program?

Jillian Dimoff (JD):

Incremental revenue is additional spend that we’re able to influence or incentivize customers to make. By creating a strong value proposition, we see that loyalty members consistently spend more than non-loyalty members. This increase can happen in a single transaction, for example, through offers like bonus points encouraging larger basket sizes.

It can also be seen in frequency, where a guest who usually visits once a week is motivated by a punch card to visit twice a week. These tactics unlock the feeling of “irrationality” which motivates them to spend more and more often.

Q: Why is driving incremental revenue crucial in today’s competitive retail market?

JD:

Consumers have more options than ever when they’re looking to make purchases. To stay competitive, brands have to create a strong value prop and build an emotional connection with their customers. These customers will continue to shop with brands with rich programs that offer good discounts. For example, there’s no earn mechanism or traditional loyalty value proposition for Amazon (aside from free shipping and access to streaming for Prime members). That is, there are no incentives or offers there for customers.

Everything in retail is getting more expensive. It’s not enough to just have a program with customers that are engaged. There’s an aspect of growth that needs to be involved. Everybody wants to grow year over year (YOY). A lot of that can be attributed to a strong loyalty program, where consumers increase spend and give their share of wallet to your brand over another. If you retain 5% of your customer base, that can be attributed to an increase of between 25% to 95% of profitability.

Strategies for Driving Incremental Revenue:

Q: What are the most effective strategies that loyalty programs can use to drive incremental revenue?

JD:

If we’ve learned anything over the last decade, it’s that transactional programs are not enough to drive engagement. They don’t influence consumers as much anymore, so we have to raise the bar. That being said, every time we survey customers they almost always state that earning discounts and rewards are crucial to earn their loyalty. So, we need to be creative and we can do this in a few different ways:

- Offering interesting tiers that provide more benefits and a feeling of exclusivity build emotional connections with consumers.

- Create a truly personalized experience by leveraging progressive profiling so that each brand interaction feels like it was made specifically for the customer.

- Create non-transactional earn opportunities that are tailored to the customer and who they are purchasing for. For example, these can be referrals, product reviews, or surveys.

- Offer a diverse set of redemption options since customers love choice. Sure, everyone likes to redeem for points or dollars off, but they enjoy sweepstakes and free merchandise, too.

Q: How can businesses balance offering rewards that drive sales without eroding profit margins?

JD:

Know your customer base. If you have a truly loyal customer that is showing continual growth, they don’t need discounts and will probably respond more to other benefits because you’re part of their lifestyle. These “Growers” are a small group but the most profitable, so less eroding of margins.

The middle segment of customers are “Stable.” Perhaps they need an offer or a bump if we’re seeing stagnant activity and we need to reinforce the value of the program. This group responds to discounts and offers.

The bottom segment are “Decliners” or those that are churning and engaging less, spending less, coming in way less often. Depending on their past purchase behaviors, you could leverage a variety of tactics to get those lapsed customers re-engaged; but if customer data shows a continuous decline over a large span of time despite your efforts, then it might be best not to invest here. So don’t waste your margins.

Customer Behavior and Incremental Spend

Q: What role do tiered programs or exclusive perks play in encouraging additional spend?

JD:

Tiered programs are great because you’re letting your customers know what is expected of them so they’ll spend more to get better offers and benefits. Tiers can be aspirational for customers. Southwest Airlines’ Southwest Rapid Rewards is a great example of the effectiveness of tiers. So anyone can be a rewards member, and as you invest more share of wallet with the airline you can elevate to A-List and A-List Preferred. The co-brand credit card also helps customers to attain status faster by paying an annual fee which gets you access to even greater benefits and earn multipliers. But one promotion I LOVE is the use of “limited-time access” to the companion pass benefit. Southwest runs a companion pass promotion a few times a year that enables: data capture, enrollment, incremental spend and frequency, acquisition and referrals. Here’s how it works:

- Traditionally, a member must accrue 135K points to attain a companion pass.

- With Southwest’s promotion, anyone can enroll, purchase a flight by x date, for a minimum of x dollars and fly within a certain timeframe and earn a free companion pass that’s available for a limited time (so maybe 3 months vs. the entire year with the traditional pass) to treat a friend to a free flight.

- This allows them to acquire more customers into the program, increases those customers’ spend, and increases their frequency, (i.e. they probably wouldn’t have made that purchase outside of this promotion).

- Now they’re going to book another flight to use the companion pass. – This unlocked two incremental revenue at once!

As retailers, you can use such tactics as giving limited-time exclusive access, to give customers a taste of the benefits of a higher tier in your program. For example, Nordstroms or Bloomingdales give early access to sale events for premium level members. If the benefit is rich enough, they’ll do what it takes to keep that elevated access. (You can check out more examples in our Relationship Marketing Trends: Brand Marketing Report).

Q: Are there particular customer segments more likely to generate incremental revenue through loyalty programs?

JD:

It depends on the program and the details of what it entails, (and who’s taking advantage of it). For example, do you have lapsed customers, or customers that only purchase once a year, or every couple of years? You wouldn’t direct your marketing or budget to keep those “bad” customers.

Then you have a middle-segment, where you have an opportunity to influence spend. This is where you want to invest, for example, one-and-done purchasers that you can win back. Finally, there’s the segment of high-spenders: you’re not trying to incentivize behaviors that would have happened regardless. Instead, we want to give perks and added benefits to make them feel special (delight the customer, and really get to know them); places where we can re-engage them. And then hopefully they will refer friends to also join the program (make them your superfans).

Promotions and Offers:

Q: What types of promotions or offers have been most effective in driving incremental revenue? How can businesses use data from loyalty programs to craft targeted promotions that maximize incremental revenue?

JD:

We’ve seen a lot of success with digital punch cards and challenges. That is, a gamified approach to loyalty that is fun and engaging and allows members to earn in exchange for sharing their customer data, advocating for the program with referrals, or sharing on social media, committing to incremental purchases or visits, etc. Two examples of companies who have embraced this are Starbucks Rewards™ program, and Vans Family which is focused on building engagement and community with sweepstakes, challenges, surveys, and more which we’ve seen highlighted.

Programs that initiate second purchases are very effective. You have a limited window of opportunity to influence consumers. If they don’t make a second purchase within a certain timeframe, you could lose them. If they make a second purchase in that window, there’s a higher probability of both continued spend/return customers and referrals.

Personalization is a must-have. You can’t do offers that are generic to everybody. If you’re promoting products or services that aren’t aligned with the customers’ preferences or buying behaviors, they’re not going to be effective. Conversely, when customers feel like you really understand who they are and you get to know them, and you’re looking for those buying signals to anticipate purchases – that’s when you see the greatest success.

Through some loyalty programs, brands are doing progressive profiling where they’re collecting information straight from the customers. This can be, them looking at who in the family is doing the purchasing; and perhaps even, who are they shopping with? Amazon Prime Days is a good example of this: Other retailers launched their own sales to compete. In this way, they’re trying to personalize the customers’ experiences in the same way Amazon gave suggestions of top sale products, which Prime members were served on their Amazon Prime home page.

Measuring Incremental Revenue:

Q: What key metrics should marketers track to measure the impact of loyalty programs on incremental revenue?

JD:

The key metrics you want to track for loyalty members vs. non-members at a minimum are:

1) Annual Spend: how much are customers spending on an annual basis?

2) Average Order Value; Average Basket/Ticket Size: What is the average a customer spends for one visit?

3) Average frequency: What is the average amount of visits a customer will make to this business?

4) Customer lifetime value (CLTV): Loyalty members will have a higher lifetime value (dollars spent) than non-members.

5) Customer Retention Rate: If we see an average customer only spends 2 times per year, even getting that incremental half spend on average, it can make a huge impact on their revenue. It affects “not-so-fun” metrics too, like Churn Propensity. If we’re seeing customers fall away from the program, maybe it isn’t engaging enough, or the value prop isn’t strong enough. If a customer has a high churn propensity or is at risk, we can utilize tactics to get them back on track.

6) Redemption Rate: Are customers using their points to redeem for rewards and how often?

7) Enrollment rate: Upon launch, we might see a higher enrollment rate, the rate at which people become members, but then we may see it decline over time. This is why we recommend continually launching new benefits and rewards to keep the program fresh.

There’s a long list of metrics; but at a minimum, these are what will tell you the health of a program.

Q: How can businesses differentiate between organic revenue growth and revenue driven by loyalty programs?

JD:

To do this, you can compare purchases between members and non-members. You can see that loyalty program members have more incremental spend because brands are incentivizing that spend. Companies report on programs in earnings calls because it’s so key to their business. They report an increase in membership, or revenue, etc. So, it definitely drives purchases outside of organic growth (and affects the bottom line in that way).

Optimizing Loyalty Programs for Revenue Growth:

Q: How often should businesses review and adjust their loyalty programs to optimize for incremental revenue?

JD:

You should continuously be monitoring your loyalty program, as should your provider. There should be QBRs (Quarterly Business Reviews) and continuous measurement of metrics and benchmarks for the program. We’ve pivoted on design in the first six months or within the first few years, in some brands’ cases. Customers, and the times are always evolving, so programs have to evolve, too. Rewards are getting more personalized based on preferences and behaviors. Here are some examples we’ve seen out in the marketplace:

- Foot Locker’s loyalty program: Theirs went under a recent re-design and relaunched. And the program went from a very experiential, highly targeted towards “sneaker heads,” to a program that spoke to all customers and rewarded transactions more.

- Starbucks’ loyalty program: Their original was based on frequency. However, some customers tried to take advantage and game the system by asking cashiers to ring up their purchases in separate transactions, which caused operational issues and fraudulent activities. So, they changed their model to be based on dollar spend, instead of frequency of visits.

Bottom line: Review the program all the time! Loyalty programs are not “set it and forget it.” You need someone at the head of the program who can make strategic decisions and lead the program based on a thorough analysis.

Q: What common mistakes do marketers make that limit the incremental revenue potential of loyalty programs?

JD:

There are a number of these, but here are a few:

Cannibalism of offers: competing with other offers being presented in other parts of the company, for example email opt-in offers that pop up and de-emphasize the loyalty program’s value. It seems like there’s a sale going on all the time because customers are extremely demanding and their attention spans are short. Marketers need to be strategic in the way they manage offers so as to not reward bad behavior or provide discounts to customers who would purchase, regardless.

Right now retailers are feeling pressure to over-discount. For example, Bed, Bath & Beyond’s 20% off coupon reinforced bad behavior so that customers were trained to expect it without doing anything in exchange. It’s smarter to shift these offers into loyalty programs because brands will get more data, and be able to influence the behaviors that they want to influence.

Another issue is that some loyalty programs have become too complicated. They can be too “coupon-clippy,” (like some grocery stores and QSRs); or there is often too much responsibility put on the customer to find the offers they need.

Retail-Specific Marketing Considerations

Retail Promotions and Offers:

Q: What types of retail-specific promotions have worked best to increase customer spend?

JD:

Promotions that encourage customers to increase average order size like “Complete the outfit” challenges, or offers that unlock other benefits like free shipping for a minimum spend, bonus earn, and so on. We can present offers at the SKU- or category-level, that would complete or complement a previous purchase or an item in the cart.

Another example is the Bonus Offer promotion. These typically go out to the customer subsequent to their welcome offer. Getting customers to make that second purchase within a specific window of time guarantees future repeat purchases and engagement. Introducing more personalization and gamification is something that could be done for these customers, to give them better chances of personalized, relevant benefits and rewards.

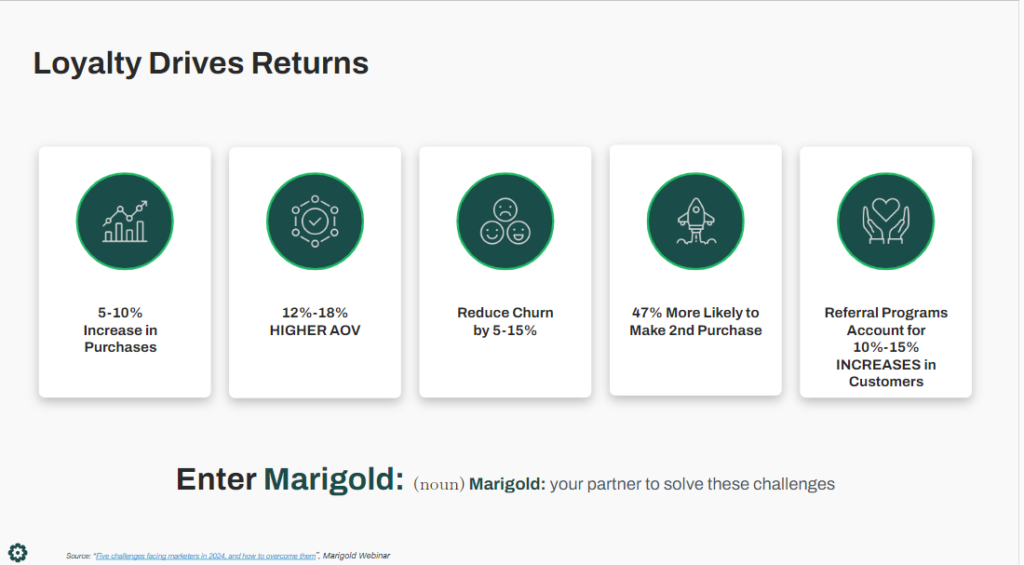

Loyalty truly does drive returns, so what you’ll see as a result, is like this slide portrays (see below): From this example, you see that it’s possible to get approximately: 5 to 10% increase in purchases; 12 to 18% higher average order value reduced churn; and 47% of customers being more likely to make a second purchase, and then referrals account for a 10 to 15% increases in customers, for this particular retailer.

Q: How can retail loyalty programs help shift customer spend from competitors, especially in highly saturated markets?

JD:

For one, know your competitors and the tactics they’re using, but most importantly know your customers and what motivates them. How do they connect with you? Almost every category can cite Amazon as a competitor; however, what are some others? What do they do that’s successful and how can you create something that’s unique to your brand that is aligned with your brand message and personality?

Brands that thrive create dynamic loyalty programs, (like Sephora, for example) and are brands that stand out, do this well. I buy my skincare from Sephora rather than Amazon because I get more out of their program. The perks? Advanced access to sales, free products, a birthday gift, and bonuses for reviewing products. But the real heart of this is giving customers choice and an array of options to earn and redeem. More brands need to do similar, creating a connected experience and leveraging anything else they have to offer.

Technology and Data for Retailers:

Q: How can retailers best leverage data from their loyalty programs to anticipate customer needs and drive incremental revenue?

JD:

You should be using your data all the time. Based on shopping behaviors and non-transactional insights, like browse behavior, surveys, etc., we can engage customers at various points along the customer journey. For instance, if we see that they shop every other month, we can increase their threshold with an offer (to encourage more) – for example, if AOV is $100, we might motivate them to spend 10-20% more.

On the flip side, if we see a customer is starting to disengage along the way, we can use predictive modeling and data driven insights to re-engage them, ultimately increasing customer lifetime value (CLTV). Always have your finger on the pulse of your customers.

Retail Case Studies and Innovations

Q: Can you share any case of a retailer (or retailers) that successfully used its loyalty program to boost incremental revenue?

JD:

We’ve seen several companies out in the retail space that are doing loyalty programs right. Meaning, they’re not just transactional, they’re layering in experiences and diverse earn and redemption opportunities while still being true to their brand values. Some of them include Talbots, Journeys, The North Face, Vans, Sephora, Columbia, Adidas, and Fleet Feet. The list goes on.

Q: What innovations should retailers consider to stay ahead in leveraging loyalty programs for revenue growth?

JD:

AI/Machine Learning, personalization, and offer management capabilities are all innovations that can be leveraged within retailers’ loyalty programs. We’re also seeing that retailer are utilizing channel expansion like mobile wallet. Whether you have a mobile app or not, this is a great feature to offer your customers. It allows customers to still have app functionality without having to commit to an app. We can dynamically adjust points balances, personalized offers and geo-located messaging.

Anything outside of transactional engagement will also prove to be attention-grabbing. And, here’s what to collect information on with these:

- How do we keep the dialogue going between our brand and our customers after purchase?

- How do we make programs that aren’t just based on point-per-dollar spend?

- Are there ways to earn benefits within the program? – Such as, free shipping or “Surprise and Delight?”

Consistent innovation, by adding new program features, is always a good tactic to draw in customers and the catalyst for incremental revenue.

Thank you goes to Jillian Dimoff for allowing us to share her perspective on loyalty programs, Marigold Loyalty, and the Retail industry in general, as loyalty programs boost their ever-changing landscape for the better.

Wrapping it Up

So, we see that personalization, unique perks or benefits, tiered levels of membership, and various types of incentives in loyalty programs all can lead to more incremental revenue for brands with well-thought out loyalty programs. Adding the newest, innovative enhancements such as mobile wallet and brand-specific apps only add to the versatility and exponential growth that these programs can help initiate. If you would like to learn more about Marigold’s Loyalty platform, you can view more details, here. Or contact one of our specialists to talk about a program specific to your brand’s needs.

For more on relationship marketing and the retail market, you can also find learnings and consumer research along with some relevant loyalty metrics, in our Relationship Marketing Trends: Brand Rankings Report, and get all the juicy insights and brand rankings, download the full report, here. And, keep an eye out for our Relationship Marketing Trends: Brand Rankings Report for Retail report, coming out later this week!

Find out more at meetmarigold.com.